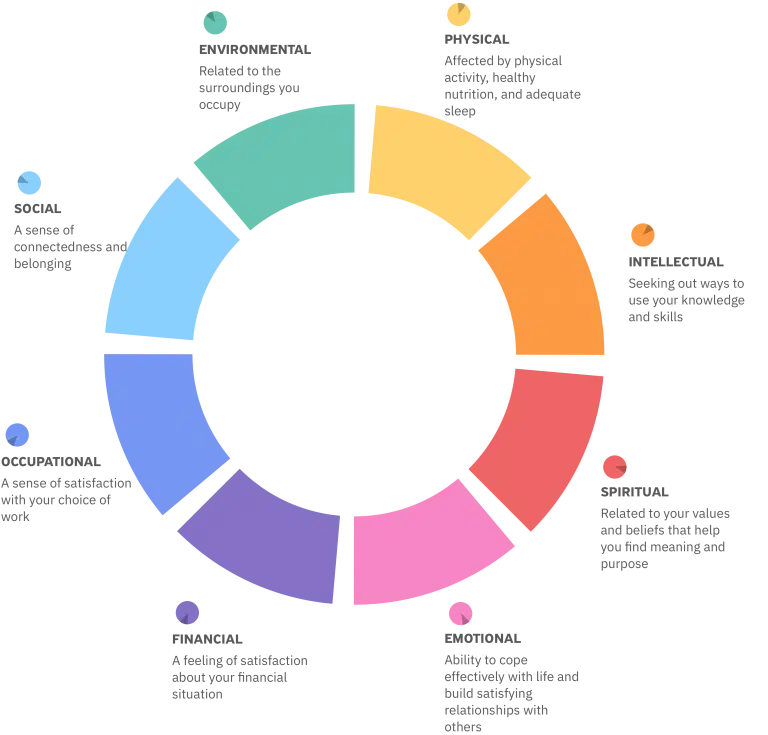

At Own Financial Planning we have one simple mission and that is to help our clients live their best life. It’s that Life is more than money. Money is simply the tool that enables you to live your best life and leave a legacy. In all of our advice we aim to align your money decisions with your Life intentions. The basis behind our advice approach is centred on Dr Margaret Swarbrick’s research on the 8 Dimensions of Wellbeing.

We believe that overall wellbeing is a healthy approach to living. It could mean doing purposeful work, enjoying good relationships, eating well, having a work-life balance and of course, financial freedom.

It is different for everyone, and as part of preparing our advice, we aim to find out what it means for you.